|

This month, our ‘Interview with...’ is with Stuart Marshall of Oakleaf Insurance. He works for a business that helps policy holders get the best out of their claims and receive what they are fully entitled to. Keep reading to find out more.

Now more than ever, businesses are looking to reduce their costs and save money. We’ve responded by offering discounts on two of our services that we think will make a difference to how your website performs.

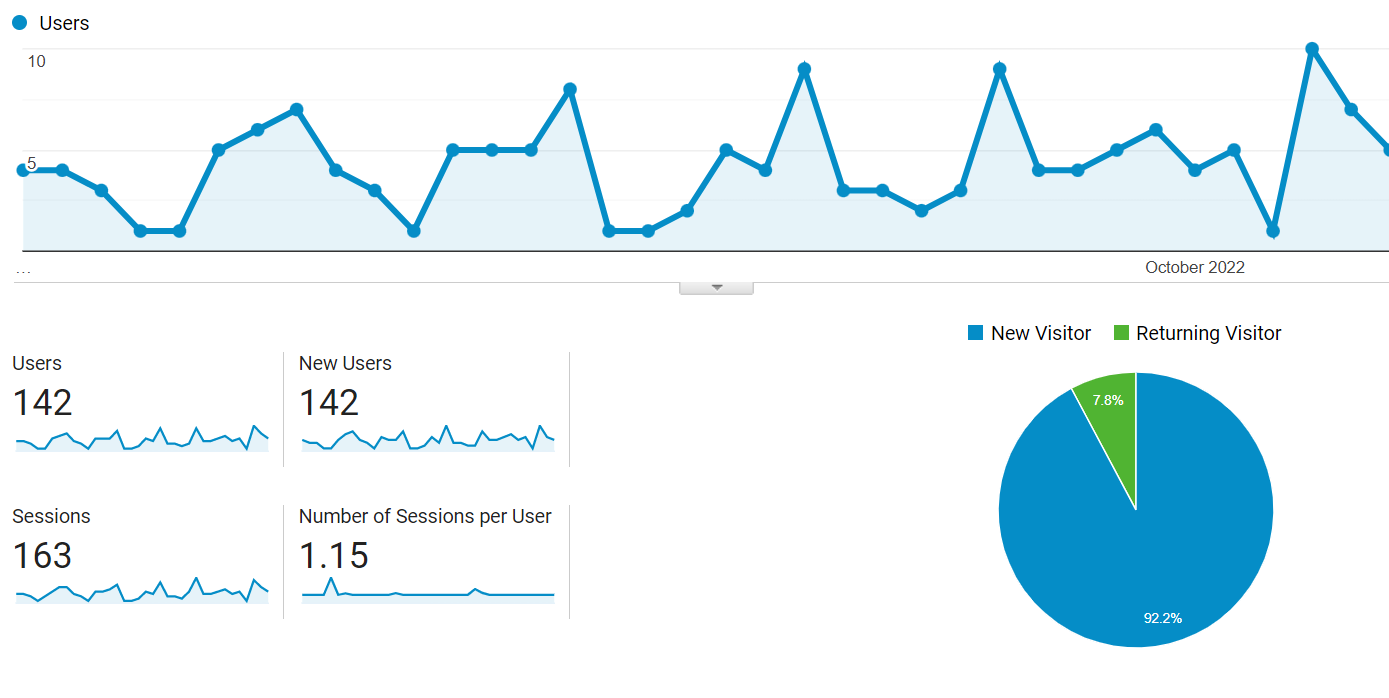

Data is the most valuable asset when growing a website for businesses, whether big or small. In 2005, Google started offering Google Analytics, and in 2006, it made it accessible to everyone. After that, more and more features were added until a newer version came out in 2012 called Universal Analytics.

Finally, in 2020, Google launched Google Analytics 4 to provide its users and business owners with a streamlined method of collecting data. Time and time again, we talk to potential clients who are in the dark about how well their website is performing for their business. We are continually astounded by the fact that they are spending money each month on website support, digital marketing and paid for advertising yet have not idea where their leads are coming from. Is this you? Don't worry, you really aren't alone!

Search engine optimisation (SEO) is one of the most popular digital marketing strategies used today, as it allows you to boost your online visibility and gain organic traffic. Whilst there are many ways to implement this, your site content will be a key area to focus on since this will help you attract users and gain credibility.

As they say, content is king in marketing, and the same principle applies to SEO. So, to make sure that you always deliver fresh content to your audience, why not start a blog on your site. Check out some of the top SEO benefits of doing this, and it may convince you to give it a go. A website is an essential ingredient in the recipe for a successful business. However, a weapon can only be as good as its wielder. Without proper planning and maintenance, a website will not function the way you want it to. It’s not easy to engage audiences with subpar content and a poorly designed website; a good website design can affect your business positively in various ways. Scroll down to learn more about them.

Designing a website is not the end of the digital marketing process. In reality, the work is just about to begin. Conducting a regular review of your business website is important for various reasons. Keep reading to find out what those reasons are.

Not the one you pair with milk. Website cookies help protect your privacy when browsing the internet. However, allowing cookies means you permit websites to remember you, your logins, and other web visits and that can be a treasure chest for criminals.

If you are someone new to understanding digital marketing, you will want to start as efficiently as possible. It is important to use the proper tools that are relatively easy to learn that will help you get known by clients that need your products or services.

Google has a variety of services that you can use, some for free and other paid for services that digital marketing novices can use. Here are the top Google tools that we recommend you use for your business. Digital marketing is an integral part of any growing business. Your website’s interaction with users plays a big role in where Google will rank your site. Websites need to engage their audiences and thus should be well-designed. User-friendly navigation is also important in sparking and maintaining customer interest. Keeping reading to learn more about the 7 signs we have identified that will let you know whether or not it's time for you to redesign your website.

Mitchell’s Miracles is a Romford based children’s charity actively seeking to raise awareness of childhood cancer, Neuroblastoma. In addition to educating the UK public about this rare disease, they actively fundraise to provide financial support to families and provide emotional assistance.

This month we are delighted to be interviewing Kristel, founder of Mitchell’s Miracles. The most challenging part about Search Engine Optimisation (SEO) is dealing with fluidity. Numerous updates change the algorithm regularly, and it's hard to keep track of all of them.

Even if you can’t follow everything, staying updated is still essential. So, here are 10 SEO tips that you should know for 2022. Design elements are what make your website look beautiful and function well. Without them, your site will end up looking like a mess. That is why it is important to know what design element you want to use before building your site.

Many different design elements available, like vectors, infographics, icons etc., can be used on the web today. Each element has its benefits and drawbacks. This article will explore some of these different types of design elements to know which one is best for you. Seven Miles Financial Planning (SMFP) provides financial planning and education for individuals and small businesses to help them achieve their lifetime dreams and goals.

This month, our ‘Interview with...’ is with Ian Miles. Search engine optimization (SEO) is one of the most popular digital marketing strategies used today, as it allows you to boost your online visibility and gain organic traffic. Whilst there are many ways to implement this, your site content will be a key area to focus on since this will help you attract users and gain credibility.

As they say, content is king in marketing, and the same principle applies to SEO. So, to make sure that you always deliver fresh content to your audience, why not start a blog on your site. Check out some of the top SEO benefits of doing this, and it may convince you to give it a go. Every business wants new customers, but there isn’t always time to find them. Wouldn’t it be nice to have a marketing strategy that could bring in new leads each month? If your business is in this position, then we can attract new customers for you with our lead generation website service.

This strategy does not work for all businesses, however if you usually get new customers through phone enquiries or visitors to your website, we can help you. Make smarter use of your marketing budget with this proven strategy. Saint Francis Hospice is an independent charity and one of the largest adult hospices in the UK. Their team of specialist consultants, doctors, nurses and a range of other health and social care professionals provide care and support to individuals with a life-limiting illness, as well as their carers and family members, completely free of charge.

This month, our ‘Interview with...’ is with Andy Furneaux from the Local Engagement Team. There are websites that get found by people who have never heard of that business before. They stumble across these sites when they are searching for a solution to a problem or a question. These websites attract new visitors. These visitors are potential new clients, if they find information that is useful or engaging. So whether you are looking to build up a distribution list, your want to inform people of your services or have products to sell, a lead generation website is what you need. If these visitors go on to make an enquiry, through a contact form, email or phones call, and they provide their contact details and permission to get in touch, then they become a lead. Having a website designed to bring in new contacts in various ways can pay itself back many times over. Watch the video or read more about how beneficial a lead generation site can be for your business. Call Perfect Layout Digital Marketing, if you need ways of generating new leads for your business. Call us on: 01708 578 015. If you are in the business of selling products or services, then having a local search listing is essential. These listings will provide your customers with information about where your business is located and what it offers. If you have never considered getting a citation before, now may be the time to do so because they can help increase traffic to your website. Read on for more information about these listings and why they are important for businesses like yours.

Welcome to Interview with… where on this occasion we are getting to know more about Sarah Brazenor, Learning Coach at Connective-Learning in Maidenhead, Berkshire. A learning coach is not an extra-curricular tutor, but instead a person who helps people understand their learning style so that they can thrive in any subject, once they have understood their natural way of absorbing information.

Our Website Health Checks are informative, quick and even more affordable with 50% off! Normally £100, you will receive an accurate picture of your online visibility; what's working – and what’s not! In addition to receiving a jargon free report, you’ll also have access to our Website Health Check expert for a 30 minute zoom or telephone call to go over our findings. Click on the Get Offer button to speak to a member of staff or find out more by checking out our Website Health Check page. Or email us to register your interest and someone will be in touch right away. Please note that this offer is not available to e-commerce websites. Offer ends 30 November 2021. You often hear that content is king in marketing, but content in itself comes in many forms. Some of the most common types include blog articles, listicles, infographics, podcasts, videos, ebooks, and the like. While these are all helpful in their own way, video content is quickly growing into one of the strongest and most important categories.

85% of businesses now use video content to promote their business, and 92% of marketers believe in its importance. In fact, video content is being used not just for marketing but also for other business processes like sales, human resources, and administration. Without a doubt, video marketing is taking over the digital space. At Perfect Layout Digital Marketing we enjoy talking to business owners about their business and their journey to where they are today. The aim of doing these interviews is to learn and share with you the personal experiences of these business owners and find out what is working for them and how.

We believe that sharing knowledge is a great way to help other businesses develop. We are passionate about promoting a variety of companies that exist not only in our local area, but also beyond the Essex borders. Read our interview with Jo Varsani, Operations Director, of The FSS Group. Are you failing to get leads from your website? Does it feel like a ghoul has hijacked business leads? Are you scared about this ever-changing world of digital marketing? Well, Perfect Layout are here to rescue you from your nightmares as we explain how Search Engine Optimisation (SEO) works. If you put in place these strategies, you will see your ranking improve. Are you ready to handle more leads coming to your business?

If you’re serious about wanting people to find you through a Google search, Search engine Optimisation (SEO) must be at the top of your priority list. For example, you you're a structural engineer looking for people planning major works to their property, you want to be sure that you website can be found. |

Topics

All

|

Insider's guide to Search Engine Optimisation

Are you ready to improve your own website? Here's a front-page preview to our guide that can help. Complete the form and download your free copy!

Perfect Layout Digital Marketing

|

HoursM-F: 9am - 5pm

|

Telephone |

|

Copyright © 2021. All rights reserved. Blog policy. Privacy Policy. Photography by Picture Partnership